Maximizing Your Business Potential with Ärilaen Käendusega

A business loan with collateral, known as ärilaen käendusega in Estonian, is a financial solution that can unlock numerous opportunities for companies looking to expand, invest, or stabilize their operations. This type of loan is secured by various forms of collateral, providing a safety net for lenders and broader options for borrowers. In this article, we will delve deep into the various aspects of collateralized business loans, their advantages, how to qualify, and expert tips to make the most of these financial tools.

Understanding Ärilaen Käendusega

Ärilaen käendusega represents a category of loans that require borrowers to pledge an asset against the borrowed funds. This means if the borrower defaults, the lender has the right to seize the asset. Common forms of collateral include:

- Real Estate: Properties, buildings, or land.

- Equipment: Machinery or tools essential for business operations.

- Inventory: Goods held for sale that can be liquidated.

- Accounts Receivable: Outstanding invoices that can be cash secured.

The Benefits of Choosing Ärilaen Käendusega

Obtaining a business loan with collateral offers several compelling advantages:

1. Lower Interest Rates

Since the loan is secured through collateral, lenders often provide lower interest rates compared to unsecured loans. This can lead to significant savings over the life of the loan and allow businesses to allocate those funds elsewhere.

2. Higher Loan Amounts

Collateralized loans generally enable borrowers to access larger amounts of capital. This can be particularly beneficial for businesses planning major expansions, upgrades, or significant operational changes.

3. Improved Approval Odds

For businesses with less-than-perfect credit, a secured loan can improve the likelihood of approval, as lenders see collateral as a form of security. This means you may qualify for financing even when your credit history might not ordinarily allow it.

How to Qualify for Ärilaen Käendusega

While the requirements for a secured business loan can vary among lenders, there are typically a few things you can expect. Here are the primary factors that will influence your eligibility:

1. Valuable Collateral

Lenders will assess the value of your collateral. Appraisals may be necessary to determine how much you can borrow based on your pledged assets. Ensuring your assets are well-maintained and documented can facilitate a smoother process.

2. Creditworthiness

Even with collateral, lenders will evaluate your credit history. A strong credit score can enhance your borrowing terms and increase your chances of obtaining a favorable loan. Understanding your credit report and addressing any discrepancies beforehand will be advantageous.

3. Business Plan and Financial Health

Having a detailed business plan and clear financial statements demonstrating the viability of your business will strengthen your case. Lenders want to understand how you intend to utilize the funds and how this aligns with your projected revenue.

Considerations When Choosing Ärilaen Käendusega

When contemplating a collateralized business loan, consider the following:

1. Type of Collateral

Choose collateral that you are comfortable risking. It's crucial to weigh the value of the asset against the potential need for cash. For many businesses, real estate can be a low-risk option, provided it has a stable value.

2. Terms of the Loan

Examine the terms carefully, including the repayment schedule, interest rates, and potential fees. Look for flexibility in terms such as early repayment without penalties.

3. Lender Reputation and Support

Research potential lenders thoroughly. Look for institutions with a solid reputation for customer service and clarity. Engaging with a trusted lender can provide ongoing support throughout the loan process and beyond.

Strategic Uses of Ärilaen Käendusega

Utilizing the funds obtained through a secured business loan can lead to numerous beneficial outcomes. Here are some strategic ways to invest in your business:

1. Expansion Opportunities

Whether you are looking to open another location, increase your operational capacity or diversify your product offerings, a business loan can provide the necessary funds to seize growth opportunities.

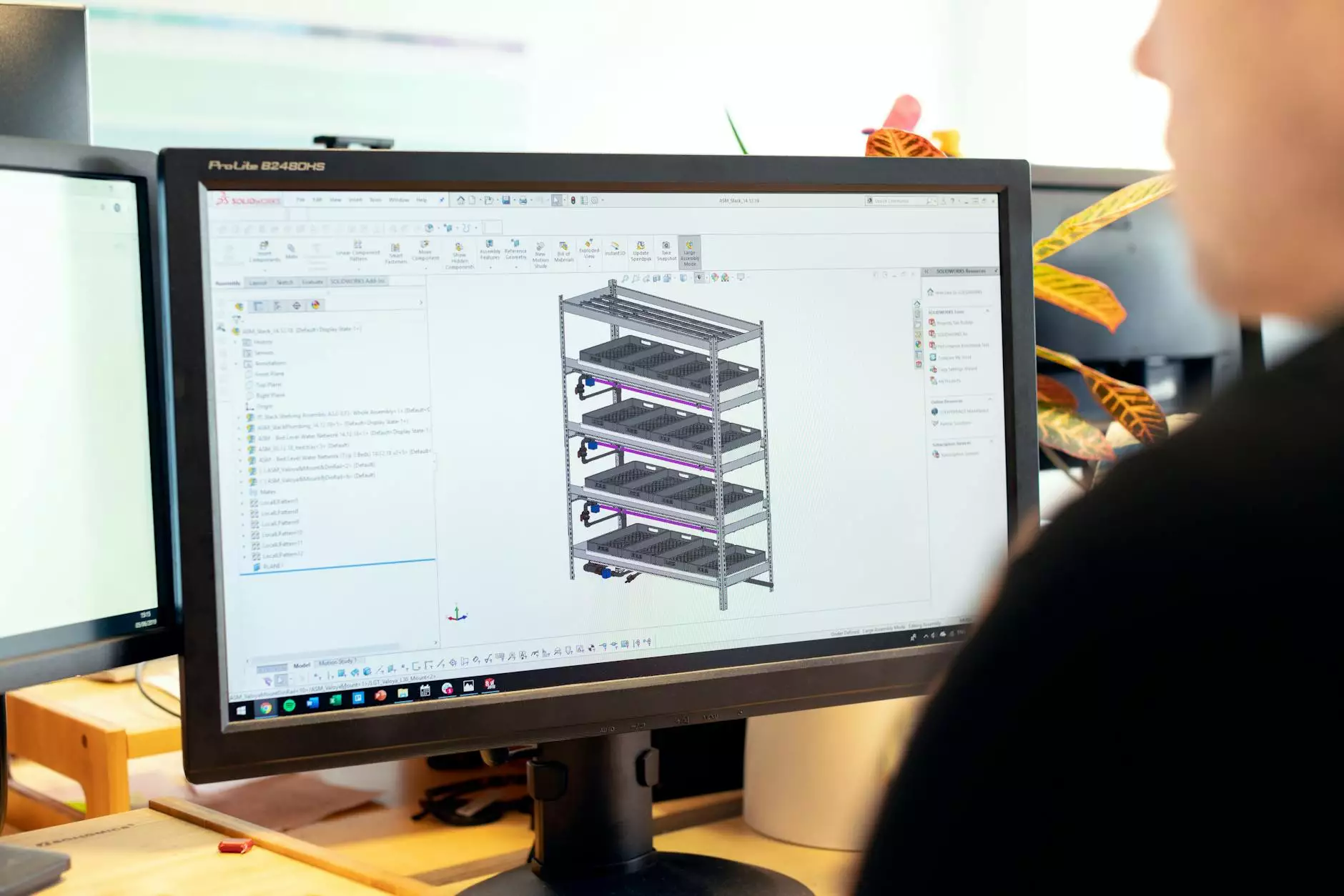

2. Upgrading Equipment

Investing in new technology or upgrading existing equipment can lead to improved efficiency and productivity, ultimately enhancing profitability.

3. Marketing Initiatives

A portion of the loan can be allocated towards marketing efforts, helping you reach new customers and expand your brand awareness. Tailored marketing strategies can include online campaigns, localized promotions, or public relations efforts.

4. Working Capital

Maintaining adequate working capital is critical for day-to-day operations. A business loan can provide necessary cash flow to cover expenses, payroll, and supplies, especially during slower periods.

Expert Tips for Managing Your Ärilaen Käendusega

Once you’ve secured a business loan with collateral, effective management is crucial:

1. Create a Detailed Budget

Implement a robust budgeting strategy to ensure funds are used effectively. Outline how much will be allocated to different areas of your business and track expenses meticulously.

2. Timely Payments

Prioritize timely mortgage payments. Developing a payment schedule aligned with your cash flow will help you maintain a positive relationship with your lender and safeguard your collateral.

3. Monitor Financial Health

Regularly assess your financial statements and business performance. Keeping a close eye on your finances can help you adjust your strategies as necessary and ensure your long-term success.

Conclusion: Empower Your Business with Ärilaen Käendusega

In conclusion, navigating the realm of ärilaen käendusega offers substantial opportunities for businesses prepared to leverage collateral for financing. By fully understanding the advantages, qualifying standards, and strategic applications of these loans, you empower your enterprise to pursue growth, stability, and innovation. Remember, the key to success lies not just in obtaining the funding but in how you utilize it to propel your business forward.

For more information on business financing options, including real estate and title loans, explore our services at Reinvest.ee.